Get My Ollo Card Review September 2021

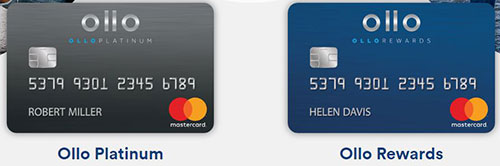

Get My Ollo Card is a credit card company that offers Mastercard credit cards. In this post we will look at Ollo Card as a company and give you a review of their Mastercard credit cards.

Ollo offer a platinum card that provides 2% cash back on your shopping. We will be looking at their cashback offers and will recommend whether or not you should apply for one.

We look also at Ollo credit card reviews from actual users in the USA and check out other reviews of Ollo Card Services.

Getmyollocard.com

The website for Ollo used to be getmyollocard.com, however it is now ollocard.com. Previously, Ollo offered credit cards on an invitation basis. Those who were invited had to go to getmyollocard.com in order to complete their sign up and to request their credit card. This credit card by Ollo Card Services is a popular choice for those looking to improve their credit rating score. An Ollo Platinum card currently has no annual fee or surprise fees.

The Mastercards were, and still are issued by The Bank of Missouri under license from Mastercard® International.

This payment card is a popular choice for individuals who have little available credit.

Who are Ollo Card

Ollo Card is a product of Fair Square Financial Holdings LLC. This company was founded in 2016. Fair Square Financial Holdings LLC are still considered to be a startup company as they are only 2 years in business.

The website has a blog that offers a lot of advice on educating their visitors on credit building and how to reduce their level of debt. The blog posts are easy to read and provide some insightful reading.

If you are struggling with debt, you should read what are the best debt consolidation services.

Why Would I Use Ollo Card

Ollo Card is a useful credit card to build your credit. It is marketed as a “credit building card”. For those with poor credit scores, an Ollo card can help with your credit report.

This card is useful if you have recently filed for bankruptcy. They may give you a high credit limit on your credit card after bankruptcy as it may be difficult for you to get funds as a result.

An Ollo Credit Card does not require annual fee at the time of writing, which is a benefit for those looking to build their credit score.

Ollo card offer zero fraud liability and it is up to the card holder to report fraudulent transactions to their credit card issuers should they discover any fraudulent activity with their card.

For those needing a credit line, Ollo card can offer that

Should You Use Ollo Card?

There are some alarming reviews on Trustpilot for this card. The reviews as of 2018 are only 4.5 out of 10 which is not great. Most of the reviews on Trustpilot are in regards to poor customer service from this financial institution.

Other Google searches lead to review sites that give Ollo Card a 4/5 rating which is decent rating for Ollo Card Services.

While no annual fee is a benefit, there are a number of people who have had a negative experience using their Ollo credit card.

Like all credit cards, you need to read the fine print to see exactly what all the terms and conditions are. If you are making an application with Ollo you need to provide accurate information.

What Is Ollo Platinum?

The Ollo Platinum credit card is referred to as an entry level credit card product. This card is a good solution for those with a poor credit rating. With the Ollo Platinum Mastercard you will not earn rewards however there are no card fees.

There will be a credit limit, but Ollo may increase this for you. They may ask for details on your credit history.

The benefits of this card include:

- No annual fee

- No foreign transaction fees

- No over-limit fee

- No returned payment fee

Ollo Card holders will receive free FICO credit score updates each month. Getting a free fico score is one of the benefits of using Ollo. This way you can improve your credit profile.

This is a useful card when you require cash advances, credit increases or making balance transfers.

What Is Ollo Rewards Card?

Ollo offer a rewards card option for customers who want to earn cashback on purchases.

With Ollo Rewards Mastercard you can earn 2% cashback on your purchases at gas stations, grocery stores and drugstores. 1% cashback is given on all other purchases made with the Ollo card.

There is a low yearly annual fee when you use Ollo Rewards.

It is also worth noting that there are no over the limit fees with Ollo Rewards secured card, meaning you have more credit when you need it most.

Ollo also will not hike your fees with late payments unlike other credit card providers. It is important however that you take the time to read the terms and conditions regarding:

- Penalty APR

- Interest charges

- Making payments

- Late fee

Check out all of our other reviews

That was our review of Ollo credit cards and hope you are now informed as to whether or not you will make a decision to try one.

We have lots of reviews on the Moneyjojo website. We will also have reviews of credit card offers in the future. Check out the latest reviews of products and services.

No comments: